What's this "conservative" of which you speak? ** -- WaxHoo 12/28/2020 4:56PM

What's this "conservative" of which you speak? ** -- WaxHoo 12/28/2020 4:56PM What's this "conservative" of which you speak? ** -- WaxHoo 12/28/2020 4:56PM

What's this "conservative" of which you speak? ** -- WaxHoo 12/28/2020 4:56PM I'm 100% against any no strings attached relief of any kind for anyone. -- psychobilly 12/28/2020 4:47PM

I'm 100% against any no strings attached relief of any kind for anyone. -- psychobilly 12/28/2020 4:47PM Loans to people living paycheck to paycheck even when they do have jobs. -- 111Balz 12/28/2020 4:55PM

Loans to people living paycheck to paycheck even when they do have jobs. -- 111Balz 12/28/2020 4:55PM Let me be more clear because i can see it was not. Loans to businesses. -- psychobilly 12/28/2020 5:00PM

Let me be more clear because i can see it was not. Loans to businesses. -- psychobilly 12/28/2020 5:00PM I would argue the reverse -- Beerman 12/28/2020 5:48PM

I would argue the reverse -- Beerman 12/28/2020 5:48PM Agree with your comments. And I’ll add that relying exclusively on loans -- TomGlansAski 12/28/2020 6:15PM

Agree with your comments. And I’ll add that relying exclusively on loans -- TomGlansAski 12/28/2020 6:15PM Gotcha. I don’t disagree with you on the PPP loans ** -- 111Balz 12/28/2020 5:03PM

Gotcha. I don’t disagree with you on the PPP loans ** -- 111Balz 12/28/2020 5:03PM Though impractical due to time, I would have liked to see a means test. -- DexterLake 12/28/2020 5:27PM

Though impractical due to time, I would have liked to see a means test. -- DexterLake 12/28/2020 5:27PM I’m no conservative, but I’m with Abe on this one -- WahooMatt05 12/28/2020 4:43PM

I’m no conservative, but I’m with Abe on this one -- WahooMatt05 12/28/2020 4:43PM Good question -- three responses:... -- Los Angeles Hoo 12/28/2020 3:53PM

Good question -- three responses:... -- Los Angeles Hoo 12/28/2020 3:53PM The govt has destroyed their livelihoods. That's really victimhood -- HoodatB 12/28/2020 8:19PM

The govt has destroyed their livelihoods. That's really victimhood -- HoodatB 12/28/2020 8:19PM On #1 -- Beerman 12/28/2020 5:41PM

On #1 -- Beerman 12/28/2020 5:41PM I think your belief that the economic pain has been caused almost entirely -- BocaHoo91 12/28/2020 4:42PM

I think your belief that the economic pain has been caused almost entirely -- BocaHoo91 12/28/2020 4:42PM Yes there would be economic impacts, but, imo there is a big difference -- CAVern 12/28/2020 6:58PM

Yes there would be economic impacts, but, imo there is a big difference -- CAVern 12/28/2020 6:58PM I guess. But Sweden had no shutdowns and experienced a nearly -- BocaHoo91 12/28/2020 7:10PM

I guess. But Sweden had no shutdowns and experienced a nearly -- BocaHoo91 12/28/2020 7:10PM Sure, but the prior point was that government should "fix what it broke" -- CAVern 12/28/2020 7:14PM

Sure, but the prior point was that government should "fix what it broke" -- CAVern 12/28/2020 7:14PM FL is also tied so much to tourism/recreation which is way down -- DexterLake 12/28/2020 5:32PM

FL is also tied so much to tourism/recreation which is way down -- DexterLake 12/28/2020 5:32PM Good points... -- Los Angeles Hoo 12/28/2020 5:24PM

Good points... -- Los Angeles Hoo 12/28/2020 5:24PM I would say in the spectrum of "panic-mongering" by governments, the -- BocaHoo91 12/28/2020 5:46PM

I would say in the spectrum of "panic-mongering" by governments, the -- BocaHoo91 12/28/2020 5:46PM I agree with part of your second point. -- Newt 12/28/2020 4:22PM

I agree with part of your second point. -- Newt 12/28/2020 4:22PM Thanks -- appreciate the post. ** -- Los Angeles Hoo 12/28/2020 5:14PM

Thanks -- appreciate the post. ** -- Los Angeles Hoo 12/28/2020 5:14PM You're back with fiscal insights that match your COVID and election ones.** -- Seattle .Hoo 12/28/2020 4:08PM

You're back with fiscal insights that match your COVID and election ones.** -- Seattle .Hoo 12/28/2020 4:08PM LOL says the guy whose... -- Los Angeles Hoo 12/28/2020 6:02PM

LOL says the guy whose... -- Los Angeles Hoo 12/28/2020 6:02PM Result in catastrophe, eh? I guess you mean your Dear Leader losing -- TomGlansAski 12/28/2020 6:20PM

Result in catastrophe, eh? I guess you mean your Dear Leader losing -- TomGlansAski 12/28/2020 6:20PM Yes. It's important to note here that Joe landslided Trump's corpulent -- Shenhoo 12/28/2020 6:32PM

Yes. It's important to note here that Joe landslided Trump's corpulent -- Shenhoo 12/28/2020 6:32PM That reality may be too painful for him to confront; hence it’s natural -- TomGlansAski 12/28/2020 6:37PM

That reality may be too painful for him to confront; hence it’s natural -- TomGlansAski 12/28/2020 6:37PM Give him a break. He predicted Trump wins in MN and OR for goodness sakes. ** -- Seattle .Hoo 12/28/2020 6:26PM

Give him a break. He predicted Trump wins in MN and OR for goodness sakes. ** -- Seattle .Hoo 12/28/2020 6:26PM Heck, he probably still believes Trump won -- TomGlansAski 12/28/2020 6:32PM

Heck, he probably still believes Trump won -- TomGlansAski 12/28/2020 6:32PM Just look at the size of the crowds! Joe's win was un-possible. ;) ** -- Seattle .Hoo 12/28/2020 6:43PM

Just look at the size of the crowds! Joe's win was un-possible. ;) ** -- Seattle .Hoo 12/28/2020 6:43PM You gonna go to the Million Maga March and wave a gun around? Cool man. ** -- Seattle .Hoo 12/28/2020 6:08PM

You gonna go to the Million Maga March and wave a gun around? Cool man. ** -- Seattle .Hoo 12/28/2020 6:08PM Regarding #2, Two bills were passed by Congress that Trump has approved. Th -- 111Balz 12/28/2020 4:05PM

Regarding #2, Two bills were passed by Congress that Trump has approved. Th -- 111Balz 12/28/2020 4:05PM Anyone that thinks/thought Trump was a fiscal conservative is clueless. ** -- DexterLake 12/28/2020 5:36PM

Anyone that thinks/thought Trump was a fiscal conservative is clueless. ** -- DexterLake 12/28/2020 5:36PM No, I think you're right... -- Los Angeles Hoo 12/28/2020 5:30PM

No, I think you're right... -- Los Angeles Hoo 12/28/2020 5:30PM I pointed out the... -- Los Angeles Hoo 12/28/2020 5:10PM

I pointed out the... -- Los Angeles Hoo 12/28/2020 5:10PM Except I don’t think that’s how things work. The fed government has an -- 111Balz 12/28/2020 5:16PM

Except I don’t think that’s how things work. The fed government has an -- 111Balz 12/28/2020 5:16PM Your last point, while valid, doesn't matter to LosAngeles... -- TomGlansAski 12/28/2020 4:18PM

Your last point, while valid, doesn't matter to LosAngeles... -- TomGlansAski 12/28/2020 4:18PM 2k seems like way too much. Deficit is out of control ** -- DTsBicep 12/28/2020 3:53PM

2k seems like way too much. Deficit is out of control ** -- DTsBicep 12/28/2020 3:53PM And yet no one is blinking an eye over a possible override of Trump's veto -- Seattle .Hoo 12/28/2020 3:40PM

And yet no one is blinking an eye over a possible override of Trump's veto -- Seattle .Hoo 12/28/2020 3:40PM I'm a John Kerry flip flopper on it, tbh. -- HAZER 12/28/2020 2:36PM

I'm a John Kerry flip flopper on it, tbh. -- HAZER 12/28/2020 2:36PM I'm in this boat as well -- CMUHoo 12/28/2020 3:17PM

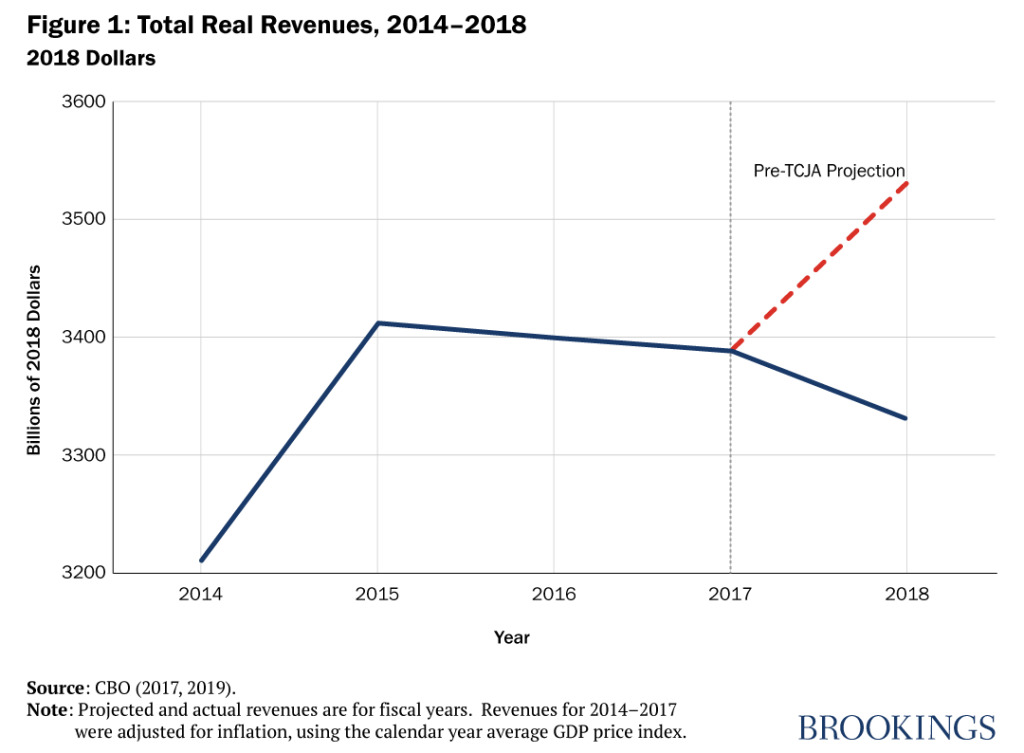

I'm in this boat as well -- CMUHoo 12/28/2020 3:17PM Despite Covid, FY20 revenues were actually higher than FY18, and only .04T -- Hoodafan 12/28/2020 3:51PM

Despite Covid, FY20 revenues were actually higher than FY18, and only .04T -- Hoodafan 12/28/2020 3:51PM Ignoring inflation and picking that window is a nice trick -- CMUHoo 12/28/2020 4:36PM

Ignoring inflation and picking that window is a nice trick -- CMUHoo 12/28/2020 4:36PM Save your effort. Many posters here have gotten into the same argument with -- 111Balz 12/28/2020 4:58PM

Save your effort. Many posters here have gotten into the same argument with -- 111Balz 12/28/2020 4:58PM Ditto. Hooduh has a certain view of the world that will never change. -- TomGlansAski 12/28/2020 6:27PM

Ditto. Hooduh has a certain view of the world that will never change. -- TomGlansAski 12/28/2020 6:27PM Because the actual facts don't support the BS and lies you want to push. So -- Hoodafan 12/28/2020 5:03PM

Because the actual facts don't support the BS and lies you want to push. So -- Hoodafan 12/28/2020 5:03PM You can see it in inflation adjusted dollars on that link I gave you. Of -- Hoodafan 12/28/2020 4:55PM

You can see it in inflation adjusted dollars on that link I gave you. Of -- Hoodafan 12/28/2020 4:55PM Revenues are growing faster than before the cuts? How are you arriving at -- BocaHoo91 12/28/2020 5:30PM

Revenues are growing faster than before the cuts? How are you arriving at -- BocaHoo91 12/28/2020 5:30PM Thanks. And there is another point here. Trump has used ever growing -- Shenhoo 12/28/2020 6:58PM

Thanks. And there is another point here. Trump has used ever growing -- Shenhoo 12/28/2020 6:58PM Thus my point about the 2015-16 window and inflation-adjustment -- CMUHoo 12/28/2020 5:33PM

Thus my point about the 2015-16 window and inflation-adjustment -- CMUHoo 12/28/2020 5:33PM You understand debt and deficit are two different things right? -- CMUHoo 12/28/2020 5:17PM

You understand debt and deficit are two different things right? -- CMUHoo 12/28/2020 5:17PM In good faith? By lobbing an insulting question suggesting I don't know the -- Hoodafan 12/29/2020 11:37AM

In good faith? By lobbing an insulting question suggesting I don't know the -- Hoodafan 12/29/2020 11:37AM My apologies for the insulting question -- CMUHoo 12/29/2020 12:51PM

My apologies for the insulting question -- CMUHoo 12/29/2020 12:51PM Those projections ended up being wrong. That's what I was trying to show -- Hoodafan 12/29/2020 1:13PM

Those projections ended up being wrong. That's what I was trying to show -- Hoodafan 12/29/2020 1:13PM Ok. I see your point on taxes, but we have to agree to disagree. -- CMUHoo 12/29/2020 2:26PM

Ok. I see your point on taxes, but we have to agree to disagree. -- CMUHoo 12/29/2020 2:26PM Fiscal 2020 includes tax revenue collected through September 30, 2020. -- 111Balz 12/28/2020 4:20PM

Fiscal 2020 includes tax revenue collected through September 30, 2020. -- 111Balz 12/28/2020 4:20PM Thanks for that Capt Obvious. Which part of this wasn't clear? -- Hoodafan 12/28/2020 4:35PM

Thanks for that Capt Obvious. Which part of this wasn't clear? -- Hoodafan 12/28/2020 4:35PM The point, for anyone willing to learn, is that the vast bulk of the Covid -- 111Balz 12/28/2020 4:51PM

The point, for anyone willing to learn, is that the vast bulk of the Covid -- 111Balz 12/28/2020 4:51PM The vast bulk? That's simply not true. 6-7 mos of personal WH and payroll -- Hoodafan 12/28/2020 5:02PM

The vast bulk? That's simply not true. 6-7 mos of personal WH and payroll -- Hoodafan 12/28/2020 5:02PM Friedman’s Permanent Income Hypothesis is a real thing -- Stimp 12/28/2020 2:11PM

Friedman’s Permanent Income Hypothesis is a real thing -- Stimp 12/28/2020 2:11PM As we used to say "You can't put the poop in the Donkey" -- DexterLake 12/28/2020 5:45PM

As we used to say "You can't put the poop in the Donkey" -- DexterLake 12/28/2020 5:45PM This is my concern. A broad expensive measure without much thought. -- Blah 12/28/2020 2:21PM

This is my concern. A broad expensive measure without much thought. -- Blah 12/28/2020 2:21PM Throwing money at problems is the political way ** -- DexterLake 12/28/2020 5:46PM

Throwing money at problems is the political way ** -- DexterLake 12/28/2020 5:46PM Or... It might be considered a ‘giveback’ to taxpayers that have overpaid -- Mr Wahoo 12/28/2020 2:08PM

Or... It might be considered a ‘giveback’ to taxpayers that have overpaid -- Mr Wahoo 12/28/2020 2:08PM It might be if that were true. ** -- Seattle .Hoo 12/28/2020 4:10PM

It might be if that were true. ** -- Seattle .Hoo 12/28/2020 4:10PM I’m glad to see at least one of you say what is said when the wealthy are -- hooshouse 12/28/2020 2:19PM

I’m glad to see at least one of you say what is said when the wealthy are -- hooshouse 12/28/2020 2:19PM Understood but the inefficiency of the government is another story/problem. -- Blah 12/28/2020 2:16PM

Understood but the inefficiency of the government is another story/problem. -- Blah 12/28/2020 2:16PM Needs to me much more targeted to those with a real need...but that might -- Tuckahokie 12/28/2020 1:34PM

Needs to me much more targeted to those with a real need...but that might -- Tuckahokie 12/28/2020 1:34PM I agree. For people in need, they are way behind because they’ve been in ne -- 111Balz 12/28/2020 1:38PM

I agree. For people in need, they are way behind because they’ve been in ne -- 111Balz 12/28/2020 1:38PM True. and i don't believe this is well thought out, however, if it WAS -- CAVern 12/28/2020 4:04PM

True. and i don't believe this is well thought out, however, if it WAS -- CAVern 12/28/2020 4:04PM Yep and here’s another really aggravating part. A lot of money was wasted i -- 111Balz 12/28/2020 4:09PM

Yep and here’s another really aggravating part. A lot of money was wasted i -- 111Balz 12/28/2020 4:09PM Think a good thought for those suffering with a substance abuse disorder or -- Tuckahokie 12/28/2020 1:44PM

Think a good thought for those suffering with a substance abuse disorder or -- Tuckahokie 12/28/2020 1:44PM The govt needs a low-cost mechanism for transferring smaller amounts -- TomGlansAski 12/28/2020 2:48PM

The govt needs a low-cost mechanism for transferring smaller amounts -- TomGlansAski 12/28/2020 2:48PM Is this the first (or next) step to Universal Basic Income? ** -- PBCHoo 12/28/2020 3:12PM

Is this the first (or next) step to Universal Basic Income? ** -- PBCHoo 12/28/2020 3:12PM It would be a useful "service" for the government to access if it chose -- TomGlansAski 12/28/2020 3:16PM

It would be a useful "service" for the government to access if it chose -- TomGlansAski 12/28/2020 3:16PM I admit my use of the pronoun "this" was a bit vague. -- PBCHoo 12/28/2020 3:54PM

I admit my use of the pronoun "this" was a bit vague. -- PBCHoo 12/28/2020 3:54PM I am not, by the Grace, an addict so I -- Shenhoo 12/28/2020 2:20PM

I am not, by the Grace, an addict so I -- Shenhoo 12/28/2020 2:20PM For those in active addiction the substance or activity rules over every -- Tuckahokie 12/28/2020 2:52PM

For those in active addiction the substance or activity rules over every -- Tuckahokie 12/28/2020 2:52PM Kind of like this -- 757 12/28/2020 1:57PM

Kind of like this -- 757 12/28/2020 1:57PM Not really. Goose unemployment instead. ** -- Beerman 12/28/2020 1:37PM

Not really. Goose unemployment instead. ** -- Beerman 12/28/2020 1:37PM Because we cannot guarantee how the money will be spent, I have questions. -- hooinblueville 12/28/2020 1:29PM

Because we cannot guarantee how the money will be spent, I have questions. -- hooinblueville 12/28/2020 1:29PM You insincere bullshit or maybe just low intellect is not acknowledging -- HokieDan95 12/28/2020 1:22PM

You insincere bullshit or maybe just low intellect is not acknowledging -- HokieDan95 12/28/2020 1:22PM Really? Aren't you same poster pushing for isolationism? -- Blah 12/28/2020 2:09PM

Really? Aren't you same poster pushing for isolationism? -- Blah 12/28/2020 2:09PM A free market dictates we don't shut down these businesses top begin with -- HokieDan95 12/28/2020 6:25PM

A free market dictates we don't shut down these businesses top begin with -- HokieDan95 12/28/2020 6:25PM LOL. You blindly follow Trump and support Stephen Miller. -- Blah 12/29/2020 09:31AM

LOL. You blindly follow Trump and support Stephen Miller. -- Blah 12/29/2020 09:31AM He doesn’t understand most of those words ** -- 111Balz 12/28/2020 2:37PM

He doesn’t understand most of those words ** -- 111Balz 12/28/2020 2:37PM I honestly don't know what he proper COVID relief should be. I know ... -- Blah 12/28/2020 2:45PM

I honestly don't know what he proper COVID relief should be. I know ... -- Blah 12/28/2020 2:45PM True. Same holds true re: aid to states and cities that so -- hoolstoptheheels 12/28/2020 2:00PM

True. Same holds true re: aid to states and cities that so -- hoolstoptheheels 12/28/2020 2:00PM And the establishment is just laughing at the American people -- ryno hoo 12/28/2020 1:32PM

And the establishment is just laughing at the American people -- ryno hoo 12/28/2020 1:32PM That’s not in the relief bill. That’s in the budget for the year previously -- 111Balz 12/28/2020 1:37PM

That’s not in the relief bill. That’s in the budget for the year previously -- 111Balz 12/28/2020 1:37PM No one cares if it is two bills. It's the laughing in the face of Americans -- ryno hoo 12/28/2020 2:29PM

No one cares if it is two bills. It's the laughing in the face of Americans -- ryno hoo 12/28/2020 2:29PM Take it up with your congressman. That money was in the budget supported by -- 111Balz 12/28/2020 2:35PM

Take it up with your congressman. That money was in the budget supported by -- 111Balz 12/28/2020 2:35PM My congressman is a socialist marxist commie who doesn't listen to me. ** -- ryno hoo 12/28/2020 3:16PM

My congressman is a socialist marxist commie who doesn't listen to me. ** -- ryno hoo 12/28/2020 3:16PM And yours is a BS talking point. -- Hoodafan 12/28/2020 2:44PM

And yours is a BS talking point. -- Hoodafan 12/28/2020 2:44PM There was not a new budget bill being voted on. It was a federal government -- 111Balz 12/28/2020 3:53PM

There was not a new budget bill being voted on. It was a federal government -- 111Balz 12/28/2020 3:53PM Which could've been amended or replaced to offset this new spending. But -- Hoodafan 12/28/2020 3:59PM

Which could've been amended or replaced to offset this new spending. But -- Hoodafan 12/28/2020 3:59PM You don’t know what you’re talking about. Just stay out of this ** -- 111Balz 12/28/2020 4:09PM

You don’t know what you’re talking about. Just stay out of this ** -- 111Balz 12/28/2020 4:09PM Oh really? What did I say that was wrong? And please show your work. ** -- Hoodafan 12/28/2020 4:29PM

Oh really? What did I say that was wrong? And please show your work. ** -- Hoodafan 12/28/2020 4:29PM This has been explained several times here already -- DownTownHoo 12/28/2020 2:25PM

This has been explained several times here already -- DownTownHoo 12/28/2020 2:25PM You seem to have a real problem with anything other than white hetero -- Plano Hoo 12/28/2020 1:34PM

You seem to have a real problem with anything other than white hetero -- Plano Hoo 12/28/2020 1:34PM Let's not rule out the possibility that's an "and" not an "or". ** -- Hoodafan 12/28/2020 1:29PM

Let's not rule out the possibility that's an "and" not an "or". ** -- Hoodafan 12/28/2020 1:29PM Maybe you 2 should stay out of an adult conversation ** -- 111Balz 12/28/2020 1:32PM

Maybe you 2 should stay out of an adult conversation ** -- 111Balz 12/28/2020 1:32PM LOL! That chance was ruined once Blah typed "Honest question". ** -- Hoodafan 12/28/2020 1:54PM

LOL! That chance was ruined once Blah typed "Honest question". ** -- Hoodafan 12/28/2020 1:54PM Well even your lying eyes should show you that there is mostly very good d -- 111Balz 12/28/2020 3:54PM

Well even your lying eyes should show you that there is mostly very good d -- 111Balz 12/28/2020 3:54PM It doesn't make sense to give money to people who don't need. Trump's -- Plano Hoo 12/28/2020 1:07PM

It doesn't make sense to give money to people who don't need. Trump's -- Plano Hoo 12/28/2020 1:07PM Didn’t Barrabus win the popular vote? Thus the release... ** -- Tuckahokie 12/28/2020 1:16PM

Didn’t Barrabus win the popular vote? Thus the release... ** -- Tuckahokie 12/28/2020 1:16PM Doesn’t the payout, whether $2k or $600, only go to -- hoolstoptheheels 12/28/2020 1:15PM

Doesn’t the payout, whether $2k or $600, only go to -- hoolstoptheheels 12/28/2020 1:15PM Yeah. I can't understand why they've not fixed that part of it yet -- Beerman 12/28/2020 1:32PM

Yeah. I can't understand why they've not fixed that part of it yet -- Beerman 12/28/2020 1:32PM We have the mechanism in place, it’s called unemployment benefits. The -- Cold Hoober Hoo 12/28/2020 1:46PM

We have the mechanism in place, it’s called unemployment benefits. The -- Cold Hoober Hoo 12/28/2020 1:46PM I would be in favor of that -- Beerman 12/28/2020 1:51PM

I would be in favor of that -- Beerman 12/28/2020 1:51PM I got no problem lowering it, just make it fair. ** -- Cold Hoober Hoo 12/28/2020 1:53PM

I got no problem lowering it, just make it fair. ** -- Cold Hoober Hoo 12/28/2020 1:53PM Because GovCo ... ** -- WaxHoo 12/28/2020 1:43PM

Because GovCo ... ** -- WaxHoo 12/28/2020 1:43PM Perhaps -- Beerman 12/28/2020 1:53PM

Perhaps -- Beerman 12/28/2020 1:53PM Yes, but if you weren't laid off or hours reduced, then you shouldn't need -- Late 80s Hokie 12/28/2020 1:18PM

Yes, but if you weren't laid off or hours reduced, then you shouldn't need -- Late 80s Hokie 12/28/2020 1:18PM That's the second part of how this has been poorly implemented -- Beerman 12/28/2020 1:36PM

That's the second part of how this has been poorly implemented -- Beerman 12/28/2020 1:36PM That's the 1st time I've heard that. A definite ass bite for many I'd wager ** -- Brown Water 12/28/2020 1:58PM

That's the 1st time I've heard that. A definite ass bite for many I'd wager ** -- Brown Water 12/28/2020 1:58PM Not sure it's correct. It would be taxable income for sure, and this round -- Hoodafan 12/28/2020 2:06PM

Not sure it's correct. It would be taxable income for sure, and this round -- Hoodafan 12/28/2020 2:06PM I appear to be mistaken -- Beerman 12/28/2020 2:35PM

I appear to be mistaken -- Beerman 12/28/2020 2:35PM Agreed. It’s using an artillery barrage to attack the problem. -- hoolstoptheheels 12/28/2020 1:25PM

Agreed. It’s using an artillery barrage to attack the problem. -- hoolstoptheheels 12/28/2020 1:25PM I think so, but i don't think its based on whether you lost job or had your -- Plano Hoo 12/28/2020 1:17PM

I think so, but i don't think its based on whether you lost job or had your -- Plano Hoo 12/28/2020 1:17PM Nope, it does not. ** -- hoolstoptheheels 12/28/2020 1:25PM

Nope, it does not. ** -- hoolstoptheheels 12/28/2020 1:25PM Correct and it’s 150K for married couples I think -- KCHoo 12/28/2020 1:20PM

Correct and it’s 150K for married couples I think -- KCHoo 12/28/2020 1:20PM Yep ** -- HAZER 12/28/2020 2:12PM

Yep ** -- HAZER 12/28/2020 2:12PM Over $150K gets it too, but on a sliding scale til it's $0 over $200K. ** -- Late 80s Hokie 12/28/2020 1:29PM

Over $150K gets it too, but on a sliding scale til it's $0 over $200K. ** -- Late 80s Hokie 12/28/2020 1:29PM I don't understand it, except as populism -- Joey Wahoo 12/28/2020 1:00PM

I don't understand it, except as populism -- Joey Wahoo 12/28/2020 1:00PM I want trickle up economics; give the money to folks who might spend it -- Quaker 12/28/2020 3:45PM

I want trickle up economics; give the money to folks who might spend it -- Quaker 12/28/2020 3:45PM Oh I think in trumps case it absolutely is populism. He wants to ride off a -- 111Balz 12/28/2020 1:35PM

Oh I think in trumps case it absolutely is populism. He wants to ride off a -- 111Balz 12/28/2020 1:35PM They should have found a way to ensure paychecks -- KCHoo 12/28/2020 1:17PM

They should have found a way to ensure paychecks -- KCHoo 12/28/2020 1:17PM I don't think the $2K is necessary. Just make sure the unemployment -- BocaHoo91 12/28/2020 12:51PM

I don't think the $2K is necessary. Just make sure the unemployment -- BocaHoo91 12/28/2020 12:51PM I tend to think more like you. I'm just wondering how we got ... -- Blah 12/28/2020 12:56PM

I tend to think more like you. I'm just wondering how we got ... -- Blah 12/28/2020 12:56PM